From innovations to impact

Eleving Group uses cutting-edge technology for rapid fund disbursement and flexibility to serve underserved communities. Innovative processes and in-house scoring models ensure sophisticated and informed decision-making through comprehensive data analysis.

The IT department supports the entire product development lifecycle, focusing on secure, stable systems that minimize costs and maximize customer conversion. Practical design and value-driven initiatives address business needs, enhancing customer conversion and portfolio management.

Investing in digitization, data processing, and risk solutions, Eleving Group stays ahead with user-friendly interfaces and convenient products. A data-centric approach optimizes customer evaluation, marketing, credit risk management, and new product development, supported by specialized tools and IT infrastructure.

Empowering inclusive economies

Eleving Group’s corporate strategy is focused on impact-making. By serving communities that conventional lenders underserve, Eleving Group brings disruptive change to the financial industry. By providing financial inclusion, the Group improves people’s lives worldwide. The Group’s ultimate purpose is to empower diverse communities worldwide by providing them with financial inclusion—thus enabling upward social mobility.

Productive lending

Access to suitable and lasting financial services empowers economically disadvantaged individuals to boost their earnings, accumulate assets, and mitigate risks from external challenges. Eleving Group has revolutionized the pre-owned vehicle market by offering financial solutions to individuals with limited access to capital.

In 2021, Mogo, the flagship brand within the Group, embarked on an innovative approach by extending productive lending services in emerging economies.

Productive lending entails funding vehicles for customers to generate income or enhance earnings from their existing enterprises. This primarily involves financing boda-bodas (motorcycle taxis) and tuk-tuks (three-wheel taxis) in Kenya and Uganda. Therefore, over 20% of the Group's portfolio serves the self-employed and SMEs, thereby increasing economic inclusion and the prosperity of local communities.

Responsible lending

Across all our products, we analyze customers’ creditworthiness utilizing public and private databases (vehicle register information, databases of government institutions, debt collection agency databases, industry/peer company blacklists, and bank statement providers) and allocates a scoring band to each customer. The automated scoring models are developed in-house and, depending on the relevant country, are either integrated into the customer relationship management systems or run on third-party cloud solutions.

Each loan application undergoes the following steps

Empowering Customer Self-Service

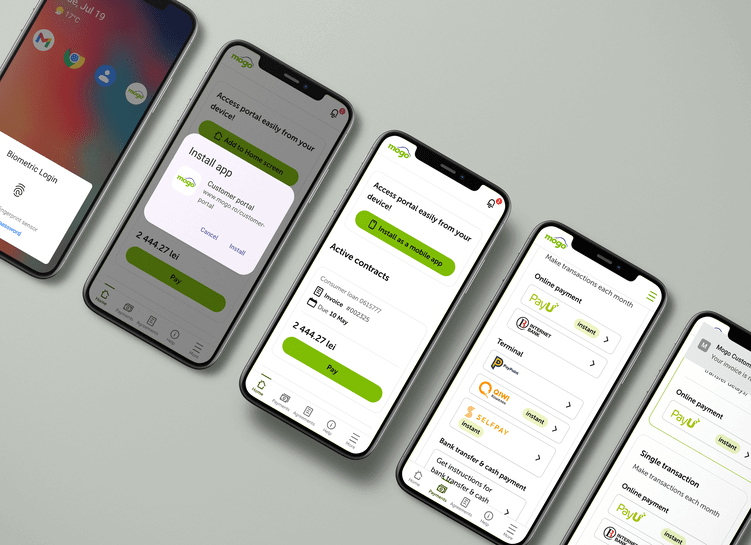

At Eleving Group, we are committed to empowering our customers through our state-of-the-art self-service platform. This platform is designed to be the ultimate one-stop shop for all client needs, providing unparalleled convenience and efficiency. The self-service platform offers a seamless, app-like experience where clients can easily access and manage their financial services. Features include quick and secure biometric login, real-time updates on loans and payments, and instant access to agreements and transaction histories. By leveraging cutting-edge technology, the self-service platform ensures that clients can complete applications, make payments, and receive personalized offers with just a few taps, enhancing their overall experience and engagement. Our vision is to see 70-80% of our clients regularly using self-service, reflecting its value and innovation in the digital financial services sector.

Enhancing Partner Collaboration

We value our partnerships and strive to provide a seamless and efficient experience for our partners through advanced self-service platforms. Our car sales partners can benefit from easy integration with our systems to streamline their operations. These platforms allow partners to quickly prepare car advertisements using AI tools and submit financing applications for our lending services. They can also track loan application progress in real-time, assist in processing applications, and monitor their sales performance and closed deals. Partners receive timely notifications about updates on customer applications and our services, ensuring they stay informed and responsive.

Our commitment to long-term relationships is reflected in the dedicated support provided by our partner account managers. These managers utilize a unified platform to track their visits, manage communications, and maintain all partner-related interactions in one place. This centralized approach not only enhances efficiency but also ensures a cohesive and supportive experience for our partners, reinforcing our dedication to mutual growth and success.

Financial literacy

We seek to work with an educated and informed customer; therefore, particular focus is placed on educating customers on financial literacy and promoting sustainable and climate-friendly decision-making.

In 2022, we developed smart.eleving.com, a financial literacy platform where anyone can assess the health of their existing loan commitments, determine whether new financial commitments would be feasible within their current budget, and find bits of advice on budgeting, debt management, saving, financial hygiene, and much more.

The platform is up and running in Latvia, Lithuania, Estonia, Romania, Moldova, Georgia, Armenia, Albania, Kenya, and Uganda, and over 80,000 unique consumers have taken the self-assessment since the launch.